GAG LAWYERS -

GROVER & GROVER ADVOCATES

GAG LAWYERS -

GROVER & GROVER ADVOCATES

Insurance Law in India is a set of rules, regulations, and guidelines for the insurance industry. Insurance law ensures that the rights of policyholders are safeguarded and that insurance companies comply with their obligations. It also regulates how insurers should conduct business, how claims should be handled, and what limits can be imposed on coverage.

Insurance law in India also establishes procedures for filing claims, resolving disputes between insurers and policyholders, and determining compensation for injuries or damages caused by an accident or illness. The Insurance Laws Act of India provides for the regulation and development of the insurance sector. It came into force on January 1, 1956. Insurance law in India is primarily administered by the Insurance Regulatory and Development Authority of India (IRDAI).

The IRDAI was established as an independent statutory body under Section 3 of the Insurance Laws Act 1956 to regulate, develop, and promote the Indian insurance industry so that it can create a sense of security among consumers.

The Ministry of Corporate Affairs (MCA) is responsible for enforcing some provisions related to financial services and corporate governance under the Companies Act 2013, as well as other laws. The Indian Insurance Laws provide for the registration of insurance companies, prohibition on unfair trade practises, establishment of defined solvency standards, prohibition on dealing with non-life insurers, regulation of domestic and foreign life insurance companies and their subsidiaries, etc. Insurance law in India is primarily administered by the Insurance Regulatory and Development Authority of India (IRDAI).

The IRDAI was established as an independent statutory body under Section 3 of the Insurance Laws Act 1956 to regulate, develop, and promote the Indian insurance industry so that it can create a sense of security among consumers. The Ministry of Corporate Affairs (MCA) is the designated authority to regulate and supervise insurance under the Companies Act, 2013.

All other regulatory powers, such as the approval of textbooks and training programmes, are vested with the IRDAI. The board consists of the following members: The current Chairman is Mr. Rajiv Gauba, who took over from Mr. Biren Poddar on April 1, 2008. The current Managing Director is Dr. V. K. Prasad, who has been in office since November 3, 2015. Mr. Ajay Gupta was appointed as MD for improvement and complaint redressal. The IRDAI is the sole regulator of health insurance in India. The IRDAI’s responsibilities include defining the mandate, policies, and standards for various types of insurance, including general health cover, life cover, and long-term care cover.

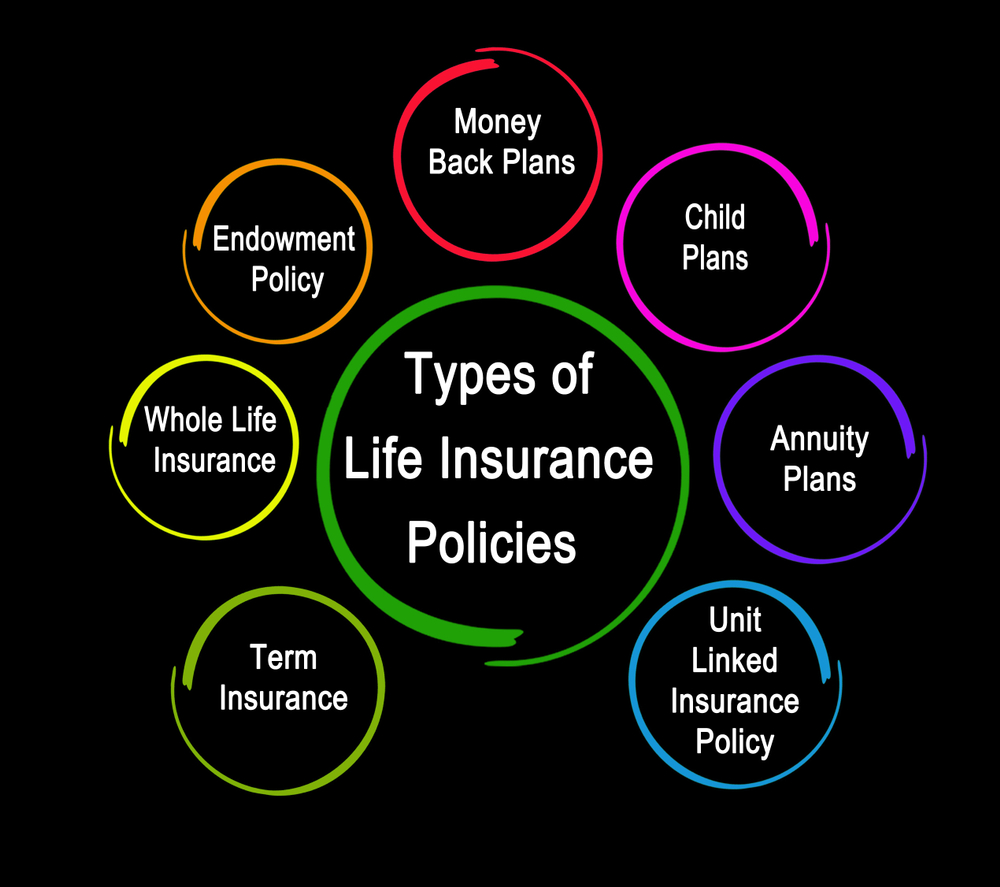

Insurance law in India is a combination of statutory law and common law. It is meant to protect the interests of policyholders by prescribing their rights and obligations towards insurance companies. The main types of insurance law in India are life insurance law, health insurance law, motor vehicle insurance law, accident insurance law, and property insurance law. Through these laws, the Indian government ensures that insurance companies provide appropriate protection to their customers.

Through these laws, the Indian government ensures that insurance companies provide appropriate protection to their customers against losses caused by the hazard. Indian insurance law is regulated by the Insurance Act, 1938, of India. This act was enacted by the British Raj in 1938, and it came into force on April 1, 1939. The act has undergone many amendments since then. The most recent amendment to this act occurred in 2005, and it is known as the Insurance Regulatory and Development Authority Act, 2005 (IRDA). The primary types of Indian insurance law are:

a) Insurance Regulatory and Development Authority (IRDA) Act:

1. The Insurance Regulatory and Development Authority (IRDA) Act, 1999, is an Act of the Parliament of India that provides for the establishment of an authority to protect the interests of holders of insurance policies, to regulate, promote, and ensure orderly growth of the insurance industry, and for matters connected therewith or incidental thereto. The Act was passed in 1999 and came into force in 2000.

2. The IRDA Act provides for the establishment of an authority to regulate the insurance business in India. It also defines the powers, duties, and functions of the Authority, provides for the licencing of insurers and agents, and lays down the terms and conditions of insurance contracts. The Act also provides for the protection of policyholders’ interests and for the supervision, control, and regulation of the insurance industry in India. It also provides for the establishment of an insurance ombudsman to settle disputes between policyholders and insurers.

b) Life Insurance Corporation Act:

1. The Life Insurance Corporation Act, 1956, is Indian legislation that regulates all life insurance businesses in India. The act was passed in 1956 with the aim of spreading life insurance much more widely and reaching rural areas with a view to reaching out to the vast masses of India. The act also aimed to provide adequate and reasonable facilities for insurance for the common man.

2. The act created the Life Insurance Corporation of India (LIC), which was given the exclusive right to transact life insurance business in India. The act also outlines the duties, powers, and obligations of the LIC. The act also provides for the formation of the Life Insurance Council, which is the governing body of the life insurance industry in India. The act also provides for the formation of the Life Insurance Advisory Board, which is responsible for the supervision and regulation of the life insurance business in India.

c) Insurance Act:

1. The Insurance Regulatory and Development Authority of India (IRDAI) is the statutory authority responsible for regulating and promoting the insurance and reinsurance industries in India. The Insurance Act, 1938, is the main legislation governing the insurance sector in India. The Act provides the framework for insurance business and sets out the responsibilities of the insurer and the insured. The Act also includes provisions relating to the formation and regulation of insurance companies, the rights and obligations of the insured and the insurer, and the settlement of disputes.

2. The Act has been amended several times since its enactment in 1938, most recently in 2016. The Insurance Laws (Amendment) Act, 2015 and the Insurance Regulatory and Development Authority of India (Amendment) Act, 2015 have been enacted to bring the Indian insurance industry in line with current global best practises. The amendments to the Insurance Act aim to increase the number of insurance companies operating in India, increase insurance penetration in the country, and enhance consumer protection.

d) Insurance Ombudsman Act:

1. The Insurance Ombudsman Act, 2019 was introduced in India in 2019. It provides a platform for the resolution of complaints relating to insurance products or services. The Act was introduced with the objective of providing an effective, simple, and speedy mechanism for the resolution of complaints by policyholders against insurance companies. It provides for the appointment of an insurance ombudsman in every state and union territory.

2. The Ombudsmen are appointed by the Central Government in consultation with the Insurance Regulatory and Development Authority of India (IRDAI). The Act also provides for the appointment of an appellate authority to hear appeals against the orders of the Ombudsman. The Act applies to all the insurance companies registered with IRDAI, except the Life Insurance Corporation of India.

e) Motor Vehicles Act:

1. The Motor Vehicles Act of 1988 is the primary legislation in India that governs all matters relating to motor vehicles. It regulates all aspects of road transport vehicles, such as registration, inspection, licencing, rules of the road, and insurance. The Act has been amended several times since its inception to keep pace with changing times. The latest amendment to the Act was made in 2019.

2. The Act covers the registration, licencing, and inspection of motor vehicles in India. It also establishes a framework for the regulation of traffic on roads and the enforcement of road safety rules. The Act also outlines the rights and duties of drivers and vehicle owners, as well as the penalties for violations of the law. Additionally, the Act provides for the formation of a Motor Vehicles Fund to finance schemes for the promotion of road safety and the development of motor vehicle technology.

f) Marine Insurance Act:

1. The Marine Insurance Act, 1963, is an Act of the Parliament of India enacted to provide for the better regulation of marine insurance and for matters connected therewith. The Act is comprehensive legislation on marine insurance and is modelled on the United Kingdom’s Marine Insurance Act, 1906. The Act is applicable to the whole of India and applies to all marine insurance contracts, including contracts of indemnity or guarantee and contracts of reinsurance.

2. It applies to contracts of marine insurance made in India as well as outside India, provided they relate to any marine adventure or concern any ship or goods within India or are subject to the maritime laws of India. The Act is administered by the Insurance Regulatory and Development Authority of India (IRDAI).

g) Insurance Claims Settlement and Surveyors Act:

1. The Insurance Claims Settlement and Surveyors Act, 1964, is an Act of the Parliament of India that regulates the activities of surveyors and loss assessors employed in the insurance industry. The Act also provides for the licencing and registration of surveyors and loss assessors. The Act was passed to ensure fair dealing between insurance companies and their customers and to ensure that claims are settled in a timely and efficient manner.

2. The Act was amended in 1999 and again in 2002 to bring it in line with the Insurance Regulatory and Development Authority Act of 1999. The Act also provides for the establishment of an Insurance Claims Settlement and Surveyors Board, which is responsible for the licencing, registration, and regulation of surveyors and loss assessors. The Board has the power to issue licences to surveyors and loss assessors and to cancel or suspend licences if necessary. The Board also has the power to inspect the premises of surveyors and loss assessors to ensure that they are following the regulations laid down in the Act.

Insurance law cases in India are legislated by the Insurance Act of 1938 and the General Insurance Business (Nationalisation) Act of 1972. The charges, penalties, and punishment that an individual may incur in insurance law cases vary depending on the type of case being prosecuted. Penalties range from fines to imprisonment, or both.

Additionally, an individual convicted of insurance fraud may be forced to pay restitution to the company or person affected by their offence. Therefore, it is important to be aware of all potential charges, penalties, and punishments that may be incurred when dealing with insurance law cases in India. Insurance law cases in India may involve a civil suit if an individual is suing for damages for insurance purposes, or potentially criminal charges if the offence resulted in bodily injury.

The penalties and punishments for insurance law cases in India depend on the specific case. Generally, the punishment for violating insurance laws can include fines, imprisonment, or both. In some cases, the court may also order the offender to pay restitution to the victim. The penalties may be imposed by a court or by an administrative or regulatory body.

1. In cases involving fraud or misrepresentation, the penalty may be imprisonment for a term of up to three years, a fine that may extend to ten thousand rupees, or both.

2. In cases of non-compliance with the provisions of the Insurance Act, 1938, or the Insurance Regulatory and Development Authority Act, 1999, the penalty may include imprisonment for a term up to six months, a fine that may extend to one lakh rupees, or both.

3. In cases of failure to comply with the provisions of any other law applicable to insurance, the penalty may include imprisonment for a term of up to three years, a fine that may extend to five thousand rupees, or both.

4. In cases of violation of the provisions of the Insurance Act, 1938, or the Insurance Regulatory and Development Authority Act, 1999, the court may also order the offender to compensate the aggrieved person for any loss or damage suffered.

5. In cases of violation of any other provision of the Insurance Act, 1938, or the Insurance Regulatory and Development Authority Act, 1999, the penalty may include imprisonment for a term of up to one year, a fine that may extend to one lakh rupees, or both.

6. In cases of criminal breach of trust by an insurer, the penalty may include imprisonment for a term of up to seven years, a fine that may extend to one lakh rupees, or both.

7. In cases of negligence or misconduct by an insurance agent, the penalty may include imprisonment for a term of up to one year, a fine that may extend to one lakh rupees, or both.

It is important to note that the penalties and punishments for insurance law cases in India may vary depending on the specific facts of the case and the applicable laws.

Insurance law is a complex area of law and requires lawyers to possess a thorough understanding of the legal remedies available in the event of any dispute or breach of contract. This article will discuss the various legal remedies available under Indian law in cases involving insurance contracts. It will assess the different approaches taken by laws in India, analyse their effectiveness, and suggest appropriate solutions to help protect the interests of insured parties.

The importance of insurance law in India cannot be understated, as it is crucial to maintaining the safety and security of both individuals and organisations. This is because, as a society, India believes that there are certain risks in life that only insurance can protect one from.

With this underlying philosophy guiding their laws, most countries have taken the approach of introducing contractual limitations on insurers so that they can be held accountable for their duties to the insured parties.

However, the Indian legal system does not recognise contractual limitations on insurers, which makes it difficult for insured parties to enforce their rights and seek remedies.

1. Civil Remedies: The insured party can file a claim in a civil court of law against the insurer for breach of contract. The court can pass an order for payment of damages, restitution, compensation, or other relief as per the terms of the insurance policy.

2. Criminal Remedies: The insured party can file a complaint against the insurer with the police for criminal breach of trust or cheating. The police will investigate the matter, and if the insurer is found guilty, the police can file a criminal case against the insurer.

3. Regulatory Relief: The insured party can approach the insurance regulator or the Insurance Ombudsman to seek relief in case of any dispute with the insurer. The regulator or the ombudsman can pass an order in favour of the insured party and can direct the insurer to pay the due amount.

4. Arbitration: The insured party can approach an arbitrator to resolve the dispute with the insurer. The arbitrator will hear both parties and pass an award in favour of the party that is found right in the eyes of the law. The award is binding on both parties, and the insurer has to abide by the award.

In India, insurance lawyers play an important role in insurance law cases. They are responsible for providing legal advice and representation to clients who have been wronged by insurance companies or have suffered a financial loss due to an insurance-related incident. Insurance lawyers help their clients understand the legal complexities of insurance laws and guide them through the entire process of filing a claim or taking legal action against an insurer. Moreover, insurance lawyers provide valuable advice on how to protect oneself from any future mishaps or losses that may arise due to negligence or mismanagement of funds by the insurer. Insurance lawyers are also instrumental in negotiating settlements between parties in such cases. Insurance lawyers who specialise in insurance law have an important role to play in helping clients understand their rights, obligations, and potential claims.

An insurance lawyer can provide advice on the best course of action for a particular case or dispute, as well as assist with negotiating settlements and representing clients in court. An insurance lawyer must be knowledgeable about both state and federal laws related to insurance policies, claims, and disputes. An insurance lawyer must also be able to interpret policy language accurately while providing sound legal advice on how best to proceed with a particular case. A lawyer who works exclusively with insurance clients is often called an insurance lawyer.

Moreover, they provide valuable advice on how to protect oneself from any future mishaps or losses that may arise due to negligence or mismanagement of the many possible responsibilities that arise. It is important to note that many people have overlapping duties within these areas. Funds by the insurer. Lawyers are also instrumental in negotiating settlements between parties in such cases in order to minimise any potential losses. What are the responsibilities of an insurer? The responsibilities of an insurer fall within three broad areas: the provision of insurance protection, the administration of a company’s finances, and the management of the company’s risk.

Within these categories, there are many possible responsibilities that arise. It is important to note that many people have overlapping duties within these areas. What are the responsibilities of an insurer? The responsibilities of an insurer fall within three broad areas: the provision of insurance protection, the administration of a company’s finances, and the management of the company’s risk. Within these categories, there are many possible responsibilities that arise. It is important to note that many people have overlapping duties within these areas.

Insurance law governs the contractual relationship between an insurance company and its policyholder. In India, filing a case related to insurance law requires certain documents to be submitted to the court. These documents include the policy document, medical reports, police reports (if applicable), and any other relevant evidence that may support your claim. It is important to ensure that all these documents are in order before filing a case related to insurance law in India.

Filing a case related to insurance law in India requires the submission of certain documents. These documents are necessary for the court to evaluate and consider the case.

The documents required for filing a case related to insurance law in India include but are not limited to, insurance policies, medical reports, legal notices or letters, affidavits, and other relevant documents. Additionally, any other document that is deemed necessary by the court may also be submitted.

In India, insurance law is controlled by the Insurance Regulatory and Development Authority of India (IRDAI). The IRDAI also controls all matters related to general insurance in the country.

The documents required to file a case related to insurance law in India depend on the nature of the case. Generally, the documents required include the following:

1. Insurance policy documents

2. Claim form

3. Medical reports

4. Supporting documents, such as bills, receipts, and other evidence

5. Certificate of registration of the company

6. A copy of the policyholder’s identity card

7. Copy of the insurer’s licence

8. Copy of the court fee challan

9. Any other relevant documents, as applicable

Grover & Grover Advocates and Solicitors, based in India, is one of the leading law firms specialising in insurance law cases. With their expertise and experience, they provide legal advice to individuals and companies that face issues related to insurance laws. They help to ensure that all parties involved in a case receive the best possible outcome. Furthermore, they also assist with the filing of claims and appeals when necessary. With their comprehensive knowledge of Indian insurance laws, Grover & Grover Advocates and Solicitors are an invaluable asset for those involved in insurance law cases.

Grover & Grover has been helping people draft their claims and advocate for them in order to provide the best possible outcome. In addition to insurance law cases, Grover & Grover Advocates and Solicitors also assist with the filing of appeals when necessary.

They have a comprehensive knowledge of Indian insurance laws, which makes them an invaluable asset for those involved in such cases. They have successfully represented thousands of individuals across India and helped many companies save millions of rupees by providing legal advice on insurance law cases.

Grover & Grover Advocates and Solicitors provide a range of services to help clients with insurance law cases in India. They can assist with:

1. Advising clients on insurance policies, including the terms, conditions, and exclusions, and determining if they are adequate coverage.

2. Negotiating with insurers to ensure the client receives a fair and appropriate settlement.

3. Representing clients in court proceedings and appeals against insurance companies.

4. Helping clients file complaints against insurance companies with the Insurance Regulatory and Development Authority of India.

5. Providing assistance with the claims process, including filing claims and gathering evidence to support their case.

6. Providing legal advice on areas such as consumer protection law, contract law, and tort law Advising clients on their rights and remedies when it comes to insurance disputes Helping clients obtain the compensation they are entitled to.

In India, insurance law has been one of the most important topics discussed in the Supreme Court and High Courts. Over the years, a number of cases have been heard in these courts, which have set precedents for future cases and provided guidance on how to interpret insurance law. In this section, we will look at some of the most popular cases related to insurance law that have been heard in India’s Supreme Court and High Courts.

Supreme Court Cases

1. United India Insurance Co. Ltd. v. Subhash Chandra Gupta (2018): This case concerned the interpretation of Section 45 of the Insurance Act, 1938. The court held that the insurer cannot reject the claim for payment of the insured’s death benefit on the ground of non-disclosure of material facts.

2. Oriental Insurance Co. Ltd. v. United India Insurance Co. Ltd. (2015): This case concerned the interpretation of Section 64VB of the Insurance Act, 1938. The court held that the insurer is not liable to pay the claim to the insured if the insured has made a false statement or suppressed material information when applying for the policy.

High Court Cases

1. Liberty India Insurance Co. Ltd. v. Meenakshi (2019): This case concerned the interpretation of Section 45 of the Insurance Act, 1938. The court held that the insurer cannot reject the claim for payment of the insured’s death benefit on the ground of non-disclosure of material facts.

2. National Insurance Co. Ltd. v. Bhagwati (2017): This case concerned the interpretation of Section 64V of the Insurance Act, 1938.